- Health-related welfare to rise sharply this decade following surge in working-age mental health claims

- New analysis shows 1,000 disability claims every working day in the decade after Covid

- Benefits exceed wages for six million workers, new CSJ analysis reveals

One in four full-time UK workers would be better off swapping wages for combined benefits, according to a stark new analysis of the welfare system by the Centre for Social Justice (CSJ).

Research carried out by the CSJ finds that soaring health-related benefits have undermined past reforms designed to ensure that work always pays.

The result is that millions of people would be able to receive more from welfare than their post-tax salary if they claimed the right combination of out-of-work and health benefits.

The full scale of the shift onto benefits is revealed by the finding that since the 2020 Covid pandemic, around 1,000 people every working day are being signed onto disability benefits following a surge in mental health conditions such as anxiety and depression.

The CSJ predicts that this 1,000-a-day increase will continue for another five years and cost taxpayers billions of pounds unless urgent action is taken.

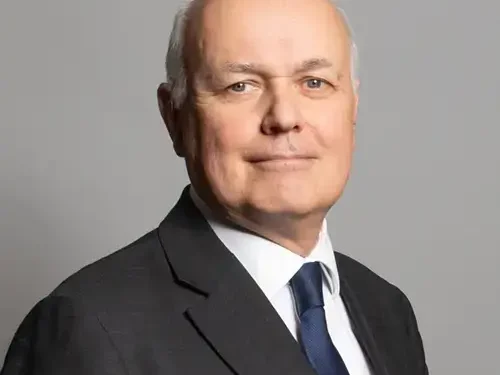

Sir Iain Duncan Smith MP, CSJ founder and architect of the welfare reforms of the last decade, said:

My reforms changed the welfare system to make work pay and brought workless households to an all-time low. But because of the post-Covid collapse in vetting and the explosion in health-related welfare claims, millions of workers could now take home more from welfare than wages after tax.

This is an outrageous state of affairs. The system must stop writing off thousands of people every day, and incentives to work must be restored to end this ruinous waste of human potential. Welfare reform is ultimately about transforming lives. The danger now is that Britain becomes a welfare state with a bankrupt country attached.

Sir Iain made his remarks as the CSJ announced the launch of a far-reaching new Welfare 2030 enquiry, intended to produce a benefits system that protects the vulnerable while restoring incentives to work.

New CSJ analysis finds that in 2025/26 an economically inactive claimant on Universal Credit (UC) for ill health, receiving the average housing element and Personal Independence Payment (PIP), would receive an income of around £25,200 – equivalent to a pre-tax salary of £30,100.

Applying this to the earnings distribution shows there are now 6.2 million full-time workers – roughly one in four – whose post-tax wages are lower than combined benefits.

Recent job adverts highlight the scale of the problem, including a prison officer role in Leicester paying £28,187, a store cleaner in Birmingham paid £26,312, and a nursing assistant in Manchester earning £24,465.

Overall, the combined benefit package is worth £3,400 more than the post-tax wages of a worker doing 40 hours a week on the National Living Wage, and £4,800 more than someone working average full-time hours.

Although around two million Universal Credit recipients are in work and can top up incomes with in-work benefits, the comparison demonstrates the powerful incentive to swap demanding, modestly paid employment for a higher benefit income with no requirement to work at all. While it is possible to claim PIP while working, fewer than one in six PIP claimants are in employment.

There are already an estimated one million claimants combining Universal Credit, housing support and health benefits to achieve a higher benefit income. Importantly, claiming health benefits exempts individuals from the benefit cap introduced in 2013 to preserve incentives to work.

While the Government has taken initial steps to address what it describes as “perverse incentives” – reducing the same benefit package to around £23,200 for new claimants after April 2026 – around 4.3 million workers will still earn less after tax than benefits even after the cut.

Analysis of official forecasts also shows that, on current trends, working-age disability benefit claims will rise by 2.4 million in the ten years following the pandemic.

That is equivalent to assessors approving almost 1,000 new Personal Independence Payment claims every working day for an entire decade, driven largely by claims for anxiety and depression, which have doubled since 2020. Meanwhile, the total number of people claiming out-of-work benefits with no requirement to work now exceeds four million.

The CSJ warns that this trajectory risks entrenching a permanent sickness-based welfare state, with serious consequences for individual wellbeing, the public finances and long-term economic growth.

Rt Hon Jonathan Ashworth, former Shadow Work and Pensions Secretary and CSJ Senior Fellow, said:

The number of people being abandoned to health-related benefits shows why welfare reform cannot be left on the ‘too difficult’ pile. With Welfare 2030, we will develop a blueprint for a system that values contribution, protects the most vulnerable, and helps thousands more people gain all of the advantages that come with work.

Joe Shalam, Policy Director at the Centre for Social Justice, said:

Universal Credit proved that welfare reform can work when rooted in clear principles and designed for delivery. But soaring health benefit claims are reversing those gains and pushing thousands out of the workforce every day.

Welfare 2030 is about repairing broken Britain and restoring work and contribution to the heart of the system while protecting those who genuinely cannot work. There is now clear cross-party recognition that the current path is unsustainable.

ENDS

Media Contact

Matt Walsh

matthew@mippr.co.uk

07754 786789

A CSJ spokesperson is available for interview.

NOTES TO EDITORS

The CSJ has made a series of interventions on the current welfare system in the build-up to Welfare 2030. These interventions, and the contribution of our 1,000-strong network of CSJ Alliance charities, can be found at: welfare2030.org.uk.

Methodology:

To calculate the take home pay of a combined benefit package analysts added the average UC housing element for out-of-work claimants in England (DWP Stat-Xplore); the UC standard allowance and elements (GOV.UK), including new measures of an above inflation increase to the standard allowance, the freezing of the health element for pre-April 2026 cases, uprating and halving of awards for post-April 2026 claims (DWP Universal Credit Bill: Universal Credit Rebalancing); and the average PIP award (DWP Stat-Xplore; GOV.UK). An economically inactive claimant on Universal Credit (UC) for ill health with the average housing benefit and Personal Independence Payment (PIP) would receive an income of around £25,200. This falls to £23,200 for those claiming after April 2026.

To earn £25,200 net of tax and national insurance requires a salary of £30,100. To estimate the number of full-time workers earning less post-tax than the benefits combination, we analysed ASHE data (ONS, 2025) finding that roughly 27.5 per cent of full-time employees took home less than £25,200 after tax. Applying this percentage to the latest LFS data (ONS, 2025) on the number of full-time workers in the UK suggests there are 6.2 million people working full-time whose wages net of tax are below combined benefits. To take home £23,200 requires a salary of £27,100 before tax. Performing the same analysis shows roughly 19 per cent of full-time workers, or 4.3 million people, earn less than the reduced benefit package coming into force on 1 April 2026.

Around two in three people claiming Universal Credit Health also receive PIP, and roughly the same proportion are in receipt of housing support in UC. While it is possible to claim PIP while in work, fewer than one in six claimants are employed. Two million claim UC while in work.

CSJ analysis of DWP caseload tables show the number of working-age PIP claimants is forecast to rise from 2.038 million in 2020/21 to 4.454 million in 2030/31, an increase of 2.416 million. Dividing the total by working days when DWP assessors are operational across the decade produces an average of 952 claims per day, rounded to 1,000.

ENDS ALL.