The Senate Finance Committee amended major tax provisions in the House’s version of President Donald Trump’s “big, beautiful bill,” and some Republicans are not happy about it.

The SALT Caucus, which advocates for an increased cap on state and local deductions, managed to do just that in the House version of the bill that was passed in May. After weeks of negotiating with Speaker Mike Johnson and Republican leadership, SALT Republicans were able to quadruple the original $10,000 cap to $40,000.

By appealing to the very stubborn SALT members, the House was able to pass the bill in an uncomfortably narrow 215-214 vote.

Although SALT Republicans were eventually able to get behind the landmark legislation, the Senate’s amendments may have alienated them and their much-needed support.

‘Not only insulting but a slap in the face to the Republican districts that delivered our majority and trifecta.’

RELATED: House narrowly passes DOGE cuts despite Republican defectors: ‘The gravy train is up’

The Senate Finance Committee pushed the $40,000 cap right back down to $10,000 on Monday, treating it as a “negotiating mark.” As expected, SALT Republicans are not on board.

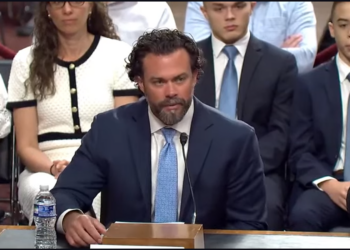

At the forefront of this dispute is Republican Rep. Mike Lawler of New York, who, like many of his other SALT colleagues, maintains that his support for the bill is conditional.

“I have been clear since Day one: sufficiently lifting the SALT Cap to deliver tax fairness to New Yorkers has been my top priority in Congress,” Lawler said in a statement Monday. “After engaging in good faith negotiations, we were able to increase the cap on SALT from $10,000 to $40,000. That is the deal and I will not accept a penny less. If the Senate reduces the SALT number, I will vote NO and the bill will fail in the House.”

“Consider this the response to the Senate’s ‘negotiating mark’: DEAD ON ARRIVAL,” Lawler added.

RELATED: Democrats vote overwhelmingly to allow illegal aliens to continue voting in key district

Other SALT Republicans echoed Lawler, saying they will pull their support for the bill if the original $40,000 cap they negotiated in the House is scrapped.

“The Senate doesn’t have the votes for $10k SALT in the House,” Republican Rep. Nick LaLota of New York said Monday. “And if they’re not sold on the House’s $40k compromise, wait until they crash the OBBB and TCJA expires — when SALT goes back to unlimited at year-end. They won’t like that one bit.”

Republican Rep. Nicole Malliotakis of New York shared her SALT colleagues’ frustrations. Malliotakis said the Senate’s amended bill is a “slap in the face,” reminding them that Republicans in moderate districts have helped secure the narrow majority they relied on to pass the legislation in the first place.

Notably, Malliotakis is the only Republican SALT member who sits on the House Ways and Means Committee, which is in charge of the tax policy drafted in the House.

“The $40,000 SALT deduction was carefully negotiated along with other tax provisions by the House of Representatives and we all had to give a little to obtain the votes to pass the Big Beautiful Bill,” Malliotakis said Monday. “For the Senate to leave the SALT deduction capped at $10,000 is not only insulting but a slap in the face to the Republican districts that delivered our majority and trifecta.”

“If we want to be the big tent party, we need to recognize that we have members representing blue states with high taxes that are subsidizing many red districts across the country with constituents who benefit from refundable tax credits despite paying zero in taxes,” Malliotakis added.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!