Florida Attorney General James Uthmeier (R) said Monday his office has launched an investigation into JPMorgan Chase Bank for allegedly cooperating with the Biden administration’s Arctic Frost investigation and targeting President Donald Trump’s media group through politically motivated “debanking” actions.

In a video announcement, Uthmeier said the state’s investigation follows “alarming revelations” that JPMorgan “coordinated with Jack Smith and the Department of Justice” in a “Biden administration operation that went after political enemies.” He added that the inquiry would examine whether the bank’s treatment of Trump Media & Technology Group, a Florida-based company that operates Truth Social, violated state consumer protection or anti-discrimination laws.

“It’s come to our attention that JPMorgan ‘debanked’ Trump Media Group, a Florida-based company, right before the business went public,” Uthmeier said. “This is a crucial time for any company — a time where you cannot afford to lose your bank.”

Smith, the special counsel appointed by former Attorney General Merrick Garland to head up two parallel criminal cases against Trump, has been under fire over recent FBI and whistleblower revelations showing the extent of surveillance Arctic Frost allowed into the lives of pro-Trump activists and Republican lawmakers related to their actions around the 2020 election and the classified documents indictments against Trump in the lead up to the 2024 election.

According to a letter Uthmeier sent on Monday to JPMorgan CEO Jamie Dimon, the investigation stems from findings released by the Senate Judiciary Committee, which revealed that Smith’s inquiry subpoenaed records from hundreds of Republican figures and entities, including Trump Media.

Here is our preservation notice to JP Morgan Chase: https://t.co/SrQ0n8gOEF pic.twitter.com/1nfFuXE5Ow

— Attorney General James Uthmeier (@AGJamesUthmeier) November 10, 2025

The March 2023 subpoena to JPMorgan sought “any and all records” related to Trump Media, including some predating the company’s existence, Uthmeier said. His letter accuses the bank of turning over “sensitive banking information from several Florida individuals, organizations, and business entities” at the request of the Biden DOJ.

The attorney general’s letter further alleges that JPMorgan began asking Trump Media “tons of questions” unrelated to routine operations and later notified the company that its accounts were being closed shortly after it completed a merger in March last year.

Uthmeier wrote that those actions “may implicate numerous Florida criminal and civil anti-fraud laws and de-banking prohibitions, as well as a breach of the basic, fundamental duties owed to your banking customers.”

JPMorgan has not directly commented on the Florida probe, but it defended its record in a statement to the Daily Wire, stating that it complies with lawful subpoenas and does not discriminate based on politics.

“We follow the law in responding to subpoenas from the government and will continue to do so,” JPMorgan spokeswoman Lauren Bianchi said. “It’s terrible that people can lose their bank accounts because of broken policies that encouraged banks to be overly cautious. It’s not fair, and it shouldn’t happen.” The Washington Examiner contacted a spokesperson for the bank.

Uthmeier said his office’s Statewide Prosecution and Enforcement Division has begun collecting evidence and directed the bank to preserve all relevant records.

“We protect Florida-based companies like Trump Media Group,” he said. “Where there’s discriminatory banking practices taking place, especially those with intent to harm, we will fight back and hold wrongdoers accountable.”

Trump Media CEO Devin Nunes said Sunday on Fox News that JPMorgan’s decision to close the company’s accounts “looked political at the time” and “makes even less sense” given that Truth Social was launched in 2022, more than a year after the Jan. 6 Capitol riot that forms part of Smith’s Arctic Frost investigation.

It sounds like JP Morgan is in Deep Shit.. 💩

🚨 Devin Nunes explains how JP Morgan was Caught in Massive Scandal debanking Trump Media Over FBI’s Bogus ‘Arctic Frost’ Witch Hunt — Only one problem, TMTG DID NOT EXIST During Jan 6

• JP Morgan suddenly debanked Trump Media &… pic.twitter.com/WZMNM2cvHj

— MJTruthUltra (@MJTruthUltra) November 9, 2025

“Should [JPMorgan Chase] have complied with this, knowing that we weren’t around?” Nunes asked. “They had to know our company wasn’t around on January 6. It doesn’t make any sense.”

Broader Arctic Frost fallout

The Florida investigation comes as Republican lawmakers intensify scrutiny of Arctic Frost, following Senate Judiciary Committee Chairman Chuck Grassley’s (R-IA) revelation last month that Verizon and AT&T were subpoenaed for phone records from at least 10 GOP lawmakers as part of Smith’s investigations into Trump.

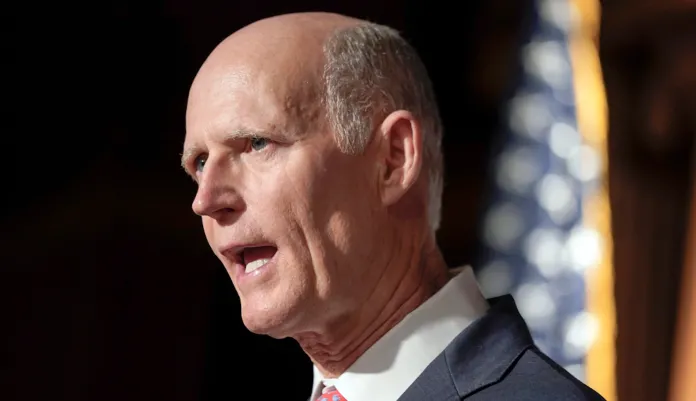

On Monday, Sens. Rick Scott (R-FL) and Marsha Blackburn (R-TN) led a letter to U.S. Attorney General Pam Bondi urging her to unseal any grand jury materials tied to Arctic Frost, which they say targeted at least 10 Republican senators with secret subpoenas for their phone records. The senators accused the Biden DOJ of “spying on their political opponents” and said the public deserves to see how Chief Judge James Boasberg of the Washington, D.C. federal court justified gag orders accompanying those subpoenas.

What Joe Biden’s DOJ did to weaponize the federal government against @MarshaBlackburn, me, and our colleagues with the Arctic Frost witch hunt is disgusting.

If they’ll come after us, they’ll go after anybody! We’re asking @AGPamBondi to use every tool at her disposal to… pic.twitter.com/ApoFHzABkO

— Rick Scott (@SenRickScott) November 10, 2025

“Jack Smith and the Biden DOJ spied on their political opponents, violated the Constitution, and weaponized the justice system to target members of Congress” in an effort to go after Trump, the senators wrote.

VERIZON TO CHANGE ITS POLICIES AFTER ARCTIC FROST SPYING REVELATIONS

JPMorgan has previously said it supports Trump’s August executive order directing regulators to investigate “politicized or unlawful debanking” by major financial institutions. Dimon has publicly criticized the Biden-era banking regulations, which he said “strong-armed” institutions into dropping certain clients.

“The rules and requirements are so onerous, and it does cause people to be debanked who, in my opinion, should not be debanked,” Dimon said earlier this year.