President Donald Trump’s move to eliminate tax credits meant to help homeowners afford energy-efficient improvements could undermine his own pledge to lower energy costs.

As part of Trump’s One Big Beautiful Bill Act, it repealed more than $500 billion of former President Joe Biden’s Inflation Reduction Act clean energy tax credits, including incentives for homeowners to make energy-efficient upgrades and improvements to their properties.

The tax credits repeal comes at a time when electricity prices are continuing to rise faster than inflation. As of August, electricity prices have increased by 6.2% for the year, and prices have increased by 0.2% on a month-to-month basis, according to the Bureau of Labor Statistics’ latest Consumer Price Index report.

Terminated tax credits

Specifically, the bill ended the Residential Clean Energy Credit, which offers up to 30% of the cost for homeowners who install qualifying clean energy systems on their property, such as solar panels, solar-powered water heaters, geothermal heat pumps, fuel cells, wind turbines, or battery storage technology.

It also repealed the Energy Efficient Home Improvement Credit, which offered homeowners credits for making energy-efficient upgrades to their homes. The credit is capped at $3,200 per year.

The credit is divided, allowing homeowners to obtain $1,200 for purchasing air conditioners, water heaters, and hot water boilers, as well as insulation, exterior doors, windows, and skylights. Homeowners can get $2,000 credit for purchases of heat pumps, water heaters, biomass stoves or biomass boilers.

Both credits expire at the end of the year, and homeowners must obtain credits by installing upgrades before December 31.

Tax credit benefits

Lowell Ungar, Director of Federal Policy at the American Council for an Energy-Efficient Economy, said that data from 2023 shows that 2.3 million taxpayers took advantage of these tax credits.

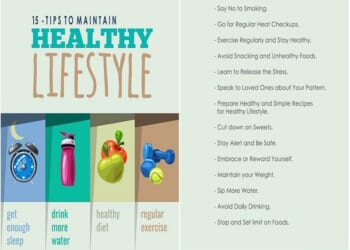

“There are many millions of homes out there that need improvement, and this is helping people pay for improvements they really want to make, because they make their homes better. They often make them more comfortable, healthier sometimes, and certainly lower their energy bills,” Ungar said.

There is often a higher upfront cost to get more efficient products, but families are saving money year after year on energy costs, he added. Ungar said that a family is saving more than $500 a year due to all the improvements that have occurred, such as updated windows, insulation, and heat pumps.

“The home efficiency improvement credit is helping people save money on their energy bills,” Ungar said. “This is an incentive that was helping people reduce their costs, helping them save money every month. And so to us, it just didn’t make any sense. If your goal is to reduce energy bills, this is doing it, and reversing it is going to mean people are going to have higher energy bills.”

For instance, heating and cooling is the most extensive energy consumer in a home. Homeowners and renters can qualify for tax credits when looking to upgrade their central air conditioning system to a more energy efficient one. Consumers could claim a credit up to 30% of the project cost.

Chris Harto, senior policy analyst for transportation and energy at Consumer Reports, noted that policies such as tax credit incentives for home improvements are relatively popular among consumers.

Harto said they conducted a survey in April that found 87% of Americans agree that new home appliances sold in the U.S. should be required to achieve minimum levels of energy efficiency, with strong bipartisan support.

It found that 94% of Democrats and 82% of Republicans support minimum energy efficiency standards. He added that 81% of Americans support government rebates or tax incentives that would help homeowners pay for improvements to the energy efficiency of their homes.

“Broadly speaking, these programs and energy efficiency standards and these types of tax credits have historically been really popular with Americans. So it’s a shame that they’re going away,” Harto said.

Experts noted that there is not a strong resentment against these types of credits, unlike energy efficient standards for appliances. The Trump administration and Republicans have rolled back many standards on appliances like commercial refrigerators, freezers, and refrigerator-freezers. Republicans have argued that these type of standards limits consumers choices and raises prices.

Still, not everyone sees the energy efficiency tax credits for home upgrades as essential or broadly impactful.

Alex Muresianu, senior policy analyst at the Tax Foundation, said the tax credits have provided some benefits to people who receive them.

But he added that a relative case for repealing these credits is that they benefit only a small group of homeowners and a limited portion of the population. Muresianu said some data shows a small number of people claiming these tax credits on their tax returns.

“There isn’t a huge fiscal cost associated with them, either. But if you want to cut taxes broadly and offset some of that fiscal cost. You’re going to need to go after a lot of smaller tax breaks,” he said.

TRUMP TO TARGET ‘RADICAL-LEFT’ GROUPS FUNDING VIOLENCE THAT LED TO CHARLIE KIRK’S DEATH

A national campaign

Meanwhile, advocacy groups are working to ensure homeowners don’t mission out on the tax credits before they expire.

Rewiring America has launched a national campaign to educate homeowners about the deadlines for tax credits and help them understand which credits they may be eligible for.

Alex Amend, director of communications at Rewiring America, said, “We’ve always been about helping inform consumers so they can make the best choice that fits whatever they’re planning on for their home and what fits their budgets, so just getting those tools all together and trying to make sure nobody misses this opportunity.”

Amend said that every contractor he has spoken to has seen a significant increase in potential clients and small businesses trying to take advantage of these credits.

He noted that Rewiring America offers public sessions to educate people about the basics of electrification.

Typically, the webinar attracts 60 to 80 RSVPs; however, less than a month ago, there were 800 participants. Many of the questions during this session focused on tax credits, he added.

”People understand that if they want to save on their bills, if they want to protect themselves from energy inflation, you have to make these types of energy-efficient upgrades,” Amend said.