The stock market surged on Friday as rumors swirled about Federal Reserve Chair Jerome Powell cutting interest rates.

The Dow Jones Industrial Average rose 846 points to a new record, the S&P 500 jumped 1.5%, and the Nasdaq composite rose 1.9%.

Poor job numbers this month added fuel to the speculation that Powell could cut rates for the first time in months. President Donald Trump has often angrily prodded Powell to do so and threatened his job.

Powell said on Friday that he’s seen risks rise for the job market, but tried to encourage investors to have hope anyway. He said the job market looks ok, even if “it is a curious kind of balance.”

He added that “the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance.”

Brian Jacobsen, chief economist at Annex Wealth Management, described his reaction to Powell’s speech as “Ka-Powell.”

“The Fed isn’t going to be the party-pooper,” he added.

Interest rate cuts often cause a surge in the stock market. Trump values a booming stock market.

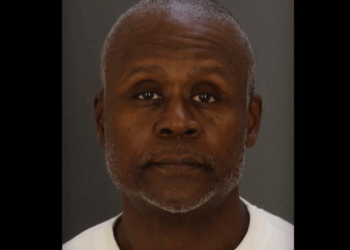

The lack of rate cuts during Trump’s second term has led the president to try to reshape the Federal Reserve, even though he appointed Powell to his position during his first term. The president has threatened to fire Federal Reserve Governor Lisa Cook if she doesn’t resign after being accused of mortgage fraud.

“What she did was bad,” Trump said of Cook. “So I’ll fire her if she doesn’t resign,” he added.

Treasury stocks fell upon news that interest rates could be cut soon. Small stocks in the Russell 2000 index surged 3.9%, an expected rise given that small companies need to borrow money to grow.

Shares of large stocks such as Nvidia, Apple, Alphabet, Amazon, and Tesla all rose more than 1.5%.

The Fed’s next meeting is in September. If Powell keeps rates the same or raises them, Trump could retaliate. At the least, Powell hinted there will be change coming to interest rates.

DON’T EXPECT BIG INTEREST RATE CUTS IMMEDIATELY AFTER POWELL IS REPLACED AT FED

He said that “the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

Powell cited shifting tax, trade, and immigration policies as reasons for change to interest rates.