In an effort to resolve a lawsuit brought by several Christian churches and religious organizations, the Internal Revenue Service has agreed to a more lenient interpretation of the Johnson Amendment, which prohibits tax-exempt organizations from engaging in political campaigns.

The 70-year-old Johnson Amendment (named after Lyndon B. Johnson) has long been used to bar certain tax-exempt organizations, including churches, from endorsing political candidates.

The problem is that this rule has never been consistently upheld or enforced, as evidenced by the frequent visits of Democrat candidates to various churches as part of their campaigning efforts. How this has not been interpreted as a violation of the Johnson Amendment is purely based upon one’s political leanings.

Furthermore, it is hard to square the Johnson Amendment with the Constitution’s protection of Americans’ First Amendment rights. How does the federal government’s failure to collect taxes against a house of worship grant it the right to effectively silence that church’s right to freedom of speech?

President Donald Trump has long called for repealing the Johnson Amendment. And while the IRS cannot repeal it, the agency has now decided to interpret it as follows: “Communications from a house of worship to its congregation in connection with religious services through its usual channels of communication on matters of faith do not run afoul of the Johnson Amendment as properly interpreted.”

The IRS added, “When a house of worship in good faith speaks to its congregation, through its customary channels of communication on matters of faith in connection with religious services, concerning electoral politics viewed through the lens of religious faith, it neither ‘participate[s]’ nor ‘intervene[s]’ in a ‘political campaign,’ within the ordinary meaning of those words.”

Last year, the National Religious Broadcasters was joined by Sand Springs Church, First Baptist Church Waskom, and Intercessors for America in filing a lawsuit against the IRS, charging that the Johnson Amendment violated their First Amendment right to freedom of speech.

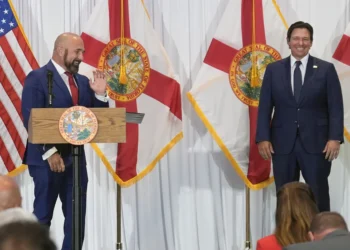

Conservative commentator Charlie Kirk, who regularly speaks at churches, praised the development, posting on X: “Churches can now endorse candidates from the Pulpit again, a freedom that never should have been taken away in the first place.” He added, “ The two most important things a church can do: 1) Preach the Gospel 2) Vote so you’re always free to do the first Praise God their free to do the second again.”

The justification for the 1954 Johnson Amendment was predicated on the separation of church and state. However, the logic behind the First Amendment’s Establishment Clause was to prevent the government from controlling the church, not forbidding the church from having any influence over the government.

What has resulted within the federal government is the establishment of a secularism that effectively seeks to forbid the church from having any political influence. This is how we ended up with no prayer in schools and the forbidding of religious symbols or messaging, like crosses or the Ten Commandments, on public property.

In other words, the Establishment Clause has been used to free the federal government from religious influence rather than uphold freedom of religion.

That said, will the IRS’s new interpretation of the Johnson Amendment last? Furthermore, at what point is a church considered in violation of the amendment? And who gets to define what constitutes a church?

These are all issues that will likely arise and need to be dealt with. However, the reassertion of free speech protections is a good thing.