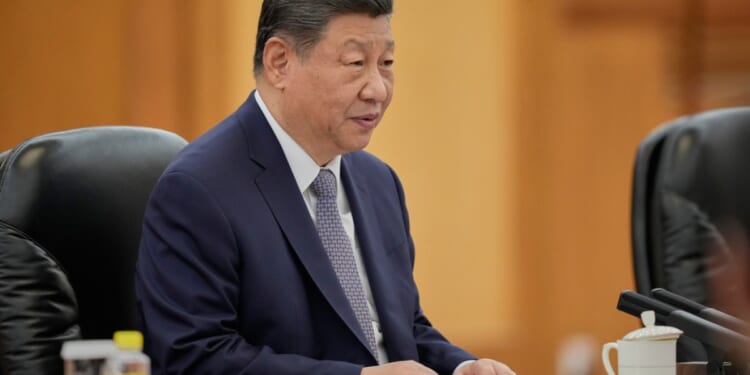

Chinese leader Xi Jinping has called for the Chinese yuan to become a global reserve currency, perhaps capitalizing on the dollar’s decline over the past year.

Over the weekend, the ruling Communist Party quoted Xi as saying Beijing needed to build a “powerful currency” that could be “widely used in international trade, investment and foreign exchange markets, and attain reserve currency status.”

Xi also stressed the need for a “powerful” central bank and strong financial institutions that can attract capital. The remarks were originally made in a speech to officials back in 2024, but were only made public this week.

The timing is notable given recent declines in the dollar, but the idea of the yuan quickly becoming a major reserve currency, or even supplanting the dollar as the world’s biggest reserve currency, is not close to happening right now.

“I think he’s benefiting from all the chaos in American policy,” Ryan Young, a senior economist at the Competitive Enterprise Institute, told the Washington Examiner.

Young said that it is easiest to look at Xi’s push in absolute and in relative terms. In absolute terms, China is not seen as the most trustworthy place to do business — there are human rights abuses, intellectual property theft, government expropriation, and more.

“But on a relative basis, what we’re seeing is a lot of America’s traditional allies and trading partners seeing the instability here, not just with tariffs, but also potential dollar devaluations here and all the other shenanigans,” Young said. “And in relative terms, China is looking a little more stable than America, and the more that continues here in America, the more that President Xi’s wish might come true.”

Dollar troubles

Notably, the U.S. dollar has posted declines. The dollar index dropped as low as 96.2 last week, down from recent highs above 99 the week before, though it has since popped a bit after President Donald Trump announced he would pick former Federal Reserve governor Kevin Warsh to lead the central bank.

The Bloomberg Dollar Spot Index reached nearly 110 in January 2025. The relative value of the greenback has fallen by more than 11% since that time in January of last year.

While there are some short-term pressures on the dollar, in the longer term, experts contend the dollar’s slide is being fueled by uncertainty in the U.S. economy, mounting concerns about the Fed’s independence, and questions about what might come next for federal tariff policy.

“If I had to summarize the dollar declining in one word, it would be uncertainty,” Steve Swedberg, finance and monetary policy analyst at the Competitive Enterprise Institute, told the Washington Examiner.

While the dollar has fallen directionally over the past year, it is still at levels that haven’t historically set off alarm bells. For instance, it was in the 70s and 80s for years following the 2008 financial crisis.

Trump himself recently drew headlines by brushing aside concerns about the greenback’s decline.

“No, I think it’s great,” Trump told reporters last week when asked about the drop. “I think the value of the dollar — look at the business we’re doing. The dollar’s doing great.”

The White House told the Washington Examiner last week that Trump remains committed to a strong dollar.

“President Trump remains committed to the strength and power of the U.S. Dollar as the world’s reserve currency,” spokesman Kush Desai said in a statement. “Foreign holdings of U.S. Treasuries reaching an all-time high and trillions in investment commitments to make and hire in America are all proof that the Trump administration’s policies are cementing America’s economic might.”

David Sacco, an instructor in finance and economics at the University of New Haven’s Pompea College of Business, said that it makes sense that Xi is pushing for the yuan to become a major reserve currency.

“Having your currency be the global reserve currency imparts a lot of power into your regime and your economy,” he told the Washington Examiner.

But China would have a long way to go.

The U.S. dollar makes up just under 60% of the currency composition of combined official foreign exchange reserves. When combined with the euro, that rises to just under 80% of all reserves. The Chinese yuan makes up a mere 2.1% of reserves.

There are also fundamental problems at play with the yuan becoming a reserve currency, according to Stephen Kates, a financial analyst at Bankrate.

“If they’re wanting to be the reserve currency, they’re doing a pretty terrible job about it,” Kates told the Washington Examiner.

He said that China has devalued its currency in the past. That is because a cheaper yuan is good for Chinese exporters and allows the country to export more to other countries.

“And that’s obviously a huge engine of growth for China, is major exports to other currencies,” Kates said.

COMMODITIES SELL-OFF CONTINUES IN MARKETS FOLLOWING WARSH FED PICK

For the yuan to become a global reserve currency, there would need to be large international holdings of the yuan to make it a strong currency, which would make Chinese exports more difficult.

“That would go against a lot of the actions that they’re doing, I mean, they’re saying, yes, we want to be reserve currency, but they’re not really acting like they would want to do that, and they’ve got a long way to go,” Kates added.