An axiom attributed to libertarian commentator P.J. O’Rourke argues, “If you think health care is expensive now, wait until you see what it costs when it’s free!” Two recent studies illustrate the veracity behind this statement and provide additional reasons for Congress not to pass another Obamacare bailout costing $350 billion plus interest.

Giveaway to Insurers

An analysis by the Joint Economic Committee’s Republican staff found that “a substantial portion of the increase in government spending” since the enhanced subsidies went into effect in 2021 “is likely accruing to producers and intermediaries.” It cites a previous study on the original Obamacare subsidies to provide the economic reasoning behind its claims.

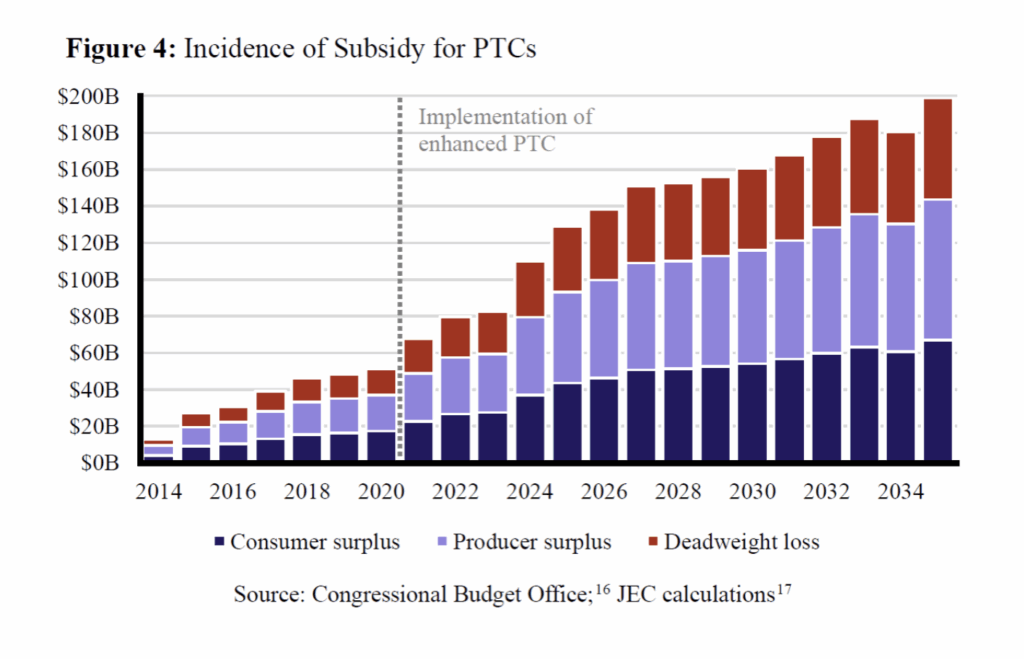

The JEC paper, using data from the earlier study, concludes that consumers received only 34 cents of every dollar in federal subsidy spending via lower net premiums. Insurers received more economic value than consumers — 38 cents on the dollar — because the subsidies, by making coverage more “affordable,” give them leverage to raise rates and capture more federal subsidy dollars, particularly in uncompetitive insurance markets. The other 28 cents constitute a deadweight loss because higher premiums discourage enrollment.

The JEC analysis finds that, even as subsidy spending has exploded since the introduction of the enhanced subsidies, the overwhelming majority of the benefits go to insurers (the purple bar in the below graph) or are destroyed by deadweight losses (the red bar), rather than helping consumers themselves (the navy-blue bar):

The graph and the study’s findings may appeal to insurers licking their chops at their ability to jack up rates if the enhanced subsidies get extended. But they shouldn’t appeal to ordinary taxpayers footing the bill for this corporate largesse.

Zero-Dollar Premiums

A separate study, by Matthew Fiedler of the Brookings Institution, examined the effects of zero-dollar premiums on enrollment. This issue has become controversial because the enhanced subsidy formula allows low-income households to qualify for zero-dollar “benchmark” plans. (Before the enhanced subsidies, a smaller percentage of individuals did enroll in zero-dollar plans, but they did so by selecting bronze plans, which typically have higher deductibles and cost-sharing.)

While nearly half (at least 45 percent) of Exchange enrollees in 2025 report income that qualifies them for zero-dollar coverage, Fiedler estimates that just over one-third (34 percent) of participants, or about 8 million, are actually enrolled in zero-dollar plans this year. Using estimates from prior studies of enrollee behavior in state Exchanges and elsewhere, Fiedler estimates that charging a de minimis premium of, say, $1 per month would cause approximately 12 percent of that 8 million to disappear from the rolls. All told, 960,000 people would lose Exchange coverage, and “federal [subsidy] costs would decline by around $7.1 billion” per year.

Fiedler describes a nominal premium on all Exchange members as “creating an additional administrative barrier to enrolling and staying enrolled.” But what Fiedler views as a bug, many Americans — including this one — would call a feature. The idea of requiring all Americans to contribute something toward their health coverage, even a small amount, would strike most families as both fair and reasonable.

Of course, state-based and federal Exchanges should ensure that individuals can pay their premiums as quickly and easily as possible, without getting bogged down in unnecessary red tape. But given the myriad reports of fraud related to the Exchanges in recent years, one could easily argue that not requiring at least a nominal premium from all households does a disservice to the taxpayers footing the vast majority of most Exchange enrollees’ premiums.

Brookings and other groups on the left view expanding coverage as the prime, if not only, outcome for health care policy and oppose anything that gets in the way of that objective. But most conservatives might well look at it from the opposite perspective and ask a reasonable enough question: If roughly 1 million people won’t even pay $1 per month to enroll in an Exchange plan, what exactly does that say about how Americans perceive the utility and value of Obamacare?